The Minister-designate for Communication, Digital Technology, and Innovations, Samuel Nartey George has promised to work on reviewing the tax buildup in the telecommunications industry, when approved by approved by parliament as the sector Minister.

While admitting that government needs to carefully balance the review of taxes and the raking in of revenue, the Minister-designate expressed concern about the high level of taxation in the telecommunications sector.

He made the remarks during his vetting before Parliament’s Appointments Committee, on Thursday January 30, 2025.

“If you look at the cost build-up for taxation, when you look at a network like Telecel, about 27.65% of their cost build-up is taxes. When you go to a network like MTN it is almost 40%, It’s important that we look at the taxes in there. I know that our government has indicated that we will repeal the Covid Levy for example”.

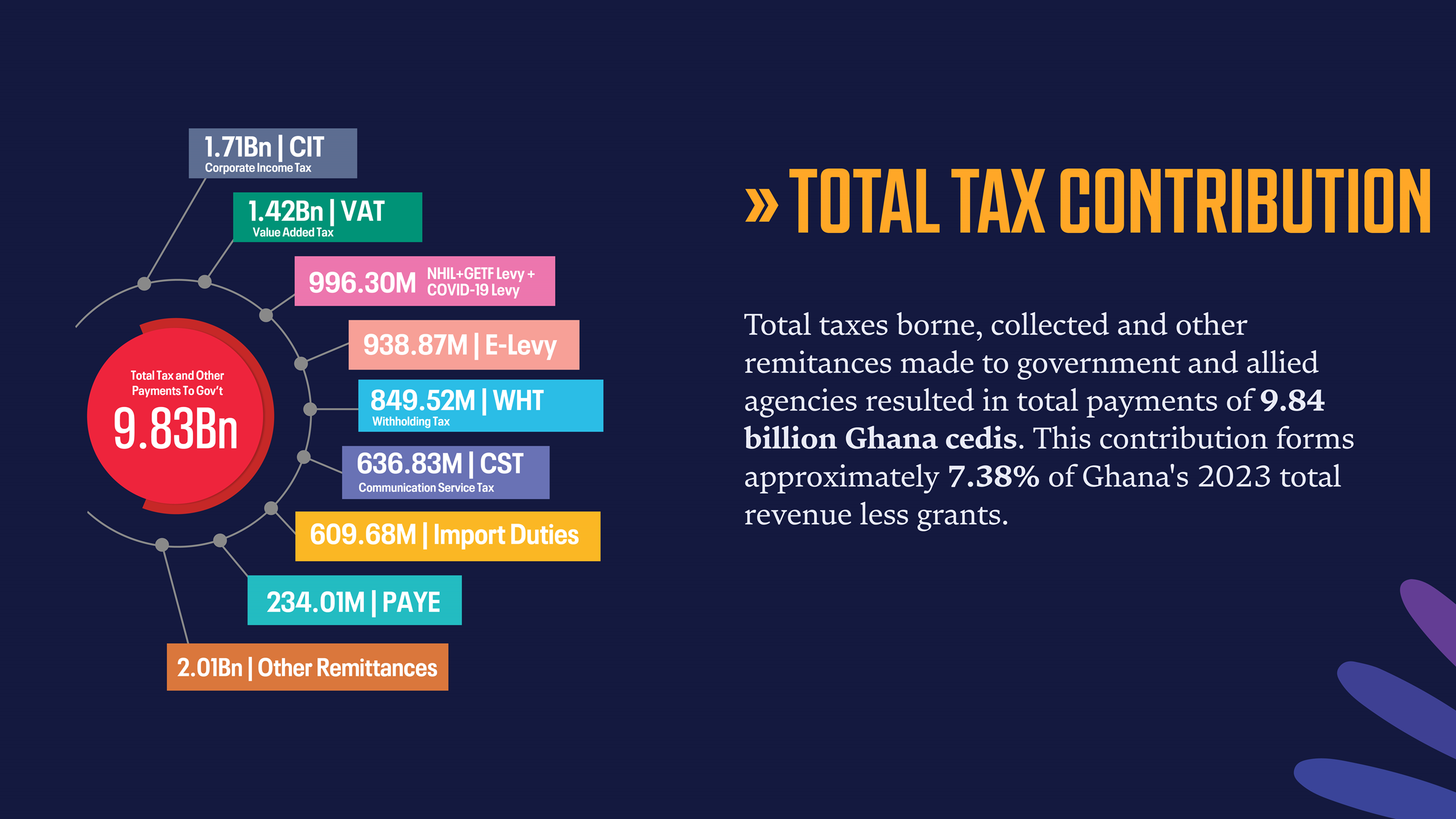

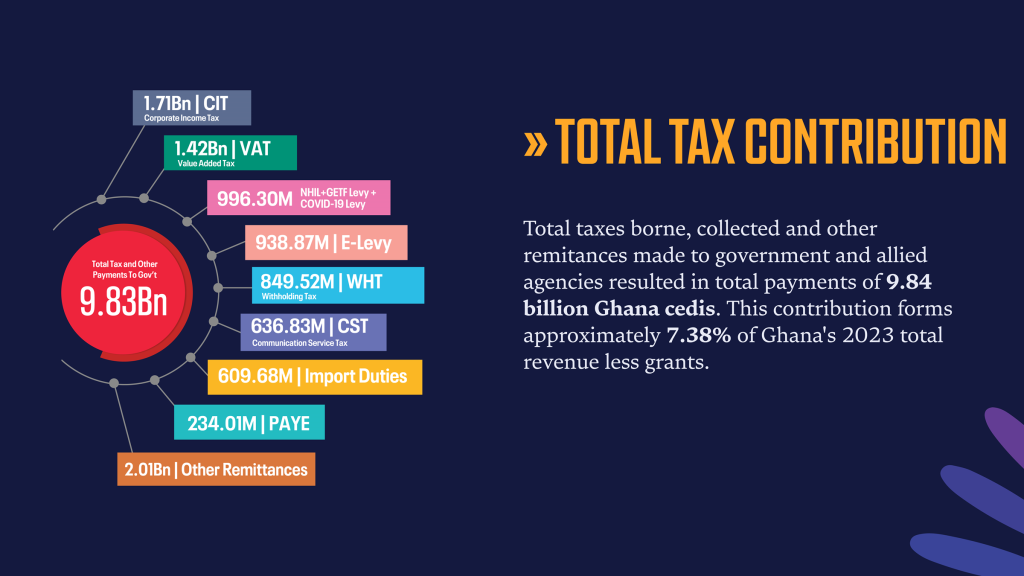

The rising tax burden on Ghana’s telecommunications industry – GHS 9.84 bn in 2023

The cost of spectrum and industry-specific taxes among many others, have made it increasingly challenging for mobile operators to expand service across Ghana. The Communications Service Tax and the Surtax on International Inbound Call Termination for example have proved particularly burdensome for the operators, limiting the amount they can invest in their networks.

The total contribution of the telecommunications industry by way of taxes, fees, levies, and other payments to government in 2023, rose by more than 30%. The industry’s overall taxes and other payments to the government in 2023 rose to GHS 9.84 billion, up from GHS 7.32 billion in 2022.

The contribution of mobile to Ghana’s economy and tax revenues

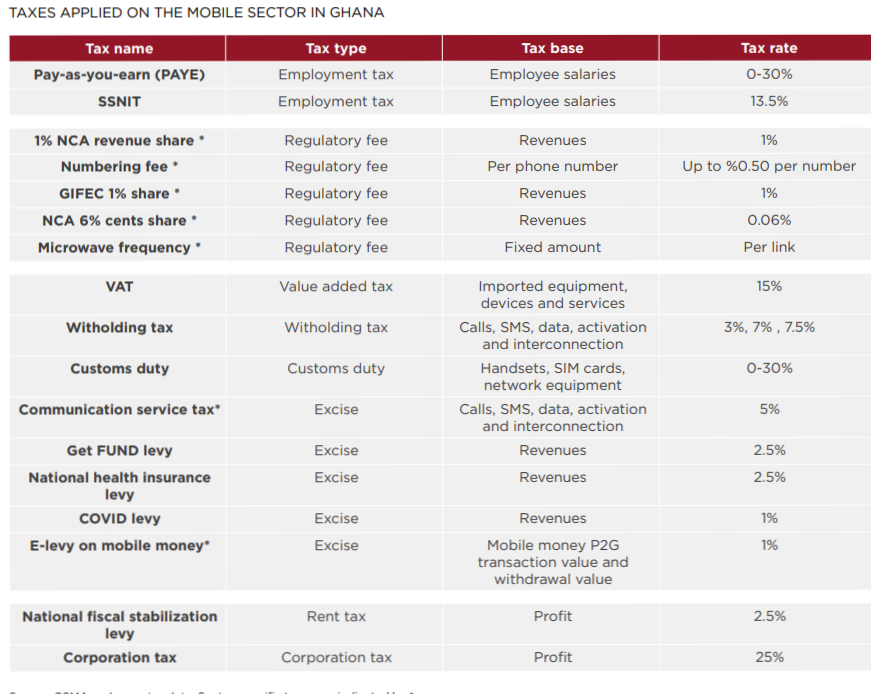

Ghana’s current economic climate and challenges in domestic revenue mobilization have created an urgent need to explore alternative tax revenue streams. The mobile sector, being highly formalized, has become a convenient target for taxation. As a result, mobile consumers and operators in Ghana face a significant tax burden, largely driven by sector-specific taxes and fees.

The mobile sector’s contribution to government tax revenue is substantial, disproportionate to its size in the economy. Various taxes and fees are levied on the sector, including several sector-specific ones. Additionally, the National Fiscal Stabilisation Levy, although not exclusively sector-specific, applies only to selected sectors, including mobile.

Source: GSMA and operators