Four suspects, one Nigerian and four Ghanaians have been arrested by the Ghana Police Service for allegedly shooting and killing a mobile money vendor in Aflao on April 28, 2025.

The arrest was made on May 10, 2025 between the hours of 1200 and 0200, by the Volta Regional Police Intelligence Department (RPID), in a joint intelligence-led operation with the Police SWAT Unit, Operation Motherland Taskforce, and ‘ACTION NOW’, a Community Watch Committee in Aflao.

These were contained in a press release published by the Ghana Police Service. According to the Service, the suspects are Michael Sewornu, aged 34, Korku Agboada, aged 43, Atsu Agbagla, aged 36 and Utsuku Onyeso, aged 22, a Nigerian. The 4 are currently in Police custody assisting in investigation.

The arrest comes almost 2 weeks from the day (April 28, 2025), when about five unidentified robbers attacked and shot Christopher Ahordo, a mobile money vendor, at Gbagblakope, near the Diamond Cement factory in Aflao, at around 6:30 pm. The deceased popularly known as Colombo, died at the scene, while the assailants took away his bag believed to contain money.

The Ghana Police Service used the press release to entreate the public to be security-conscious and collaborate with them by providing credible and timely information about criminals.

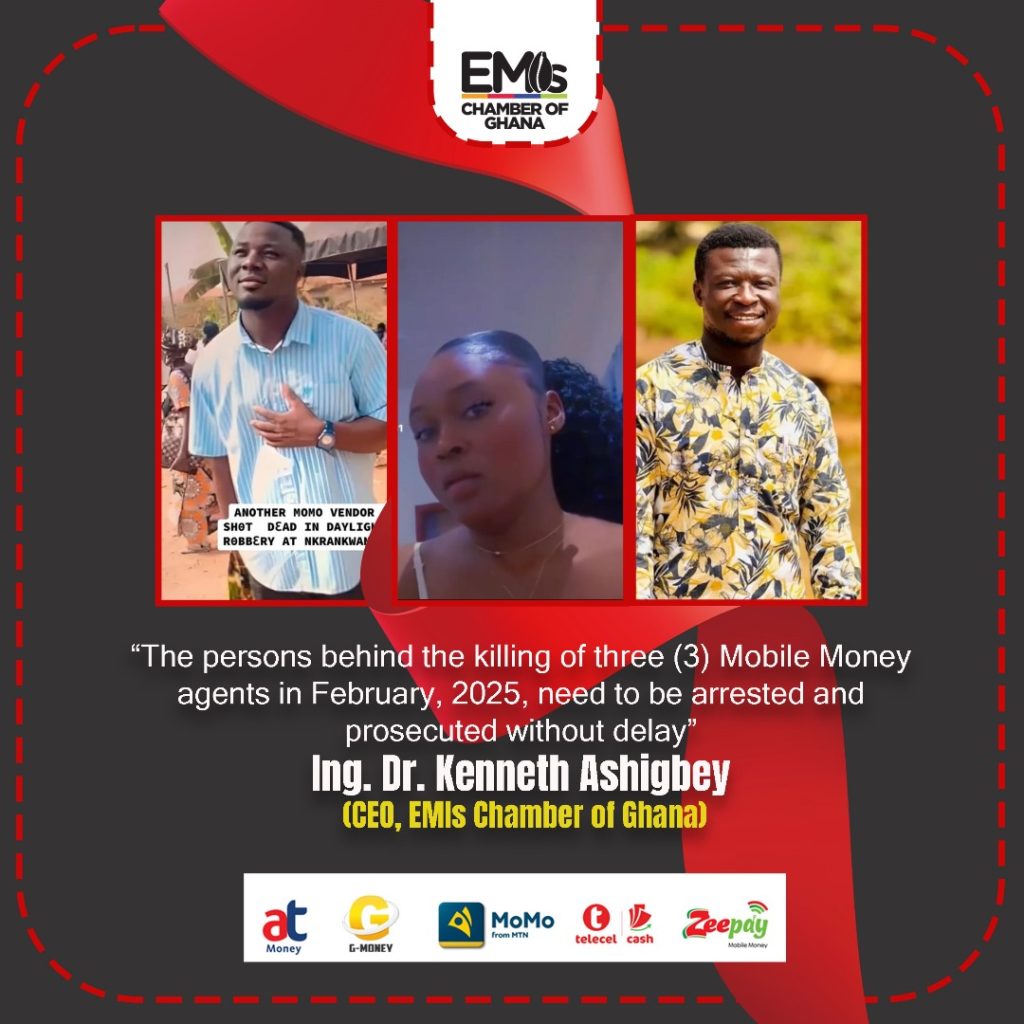

Let’s protect MoMo agents from senseless attacks – EMIs to Mahama, IGP, others

The Electronic Money Issuers (EMIs) Chamber of Ghana has strongly condemned the recent spate of violent attacks against mobile money agents, calling for urgent intervention to protect their lives and livelihoods. The Chamber extended its condolences to the families of agents who have been killed in these incidents, emphasizing that their role in Ghana’s financial ecosystem is invaluable and must be safeguarded.

Expressing deep concern over the escalating attacks, the Chamber has called on the President, the Interior and Finance Ministers, the Inspector General of Police (IGP), and the Governor of the Bank of Ghana to take immediate action. They urged law enforcement agencies to intensify efforts in apprehending the perpetrators and ensuring justice for the victims.

As part of its response, the EMIs Chamber is engaging with the leadership of the Ghana Police Service to explore effective security solutions. Additionally, discussions will be held with the Bank of Ghana to strengthen the Agent Registry and implement security measures to enhance the safety of mobile money agents.

The Chamber also debunked the misconception that mobile money agents carry large amounts of cash, warning that such misinformation makes them easy targets for criminals. They stressed that mobile money transactions are predominantly digital, with minimal cash handling.

To mitigate risks, the Chamber advised agents to adopt precautionary measures, including closing their shops early, avoiding carrying large sums of cash, installing CCTV cameras and alarm systems, and maintaining close contact with local police stations.

The Chamber reaffirmed its commitment to working with the government, security agencies, and stakeholders to address these security threats. It urged swift and decisive action to prevent further loss of life and ensure the safety of mobile money agents, who play a critical role in Ghana’s digital financial transformation.

Source: EMIs Chamber of Ghana

Source of cover image: Ghana Police Service

Infographic: The players most impacted by mobile money fraud

Infographic: The players most impacted by mobile money fraud