MTN MoMo has partnered with Sanlam Allianz Life Insurance Ghana LTD and aYo intermediaries Ghana Limited to launch a comprehensive Life Insurance cover for all MTN MoMo agents across the country.

The Life insurance is an annual renewable package that comes at no extra cost to MoMo agents. It includes coverage for permanent and total disability, temporary to total disability, critical illness, accidental medical reimbursement, hospitalization and death benefits. Agents will receive support when they are diagnosed with a critical illness (e.g. stroke, cancer, coma, major burns, major organ transplant, heart attack, kidney failure etc.). In addition, there are daily hospital cash benefits to help with medical bills if they are hospitalized.

Speaking at the launch, Chief Sales and Distribution Officer of MTN Ghana, Mr. Samuel Addo, highlighted the vital role mobile money agents play in expanding financial access in communities. He emphasized that the partnership aligns with MobileMoney LTD’s commitment to supporting agents’ welfare, complementing existing initiatives such as the provision of kiosks, laptops, motorbikes, CCTV cameras and vehicles to enhance their work.

“At MobileMoney LTD, we take agent safety and well-being seriously. We have partnered with Sanlam Allianz Life Insurance Ghana LTD and aYo Ghana Intermediaries Ghana Limited to provide enhanced coverage. This partnership reinforces our commitment to protect and empower our mobile money agents,” he said.

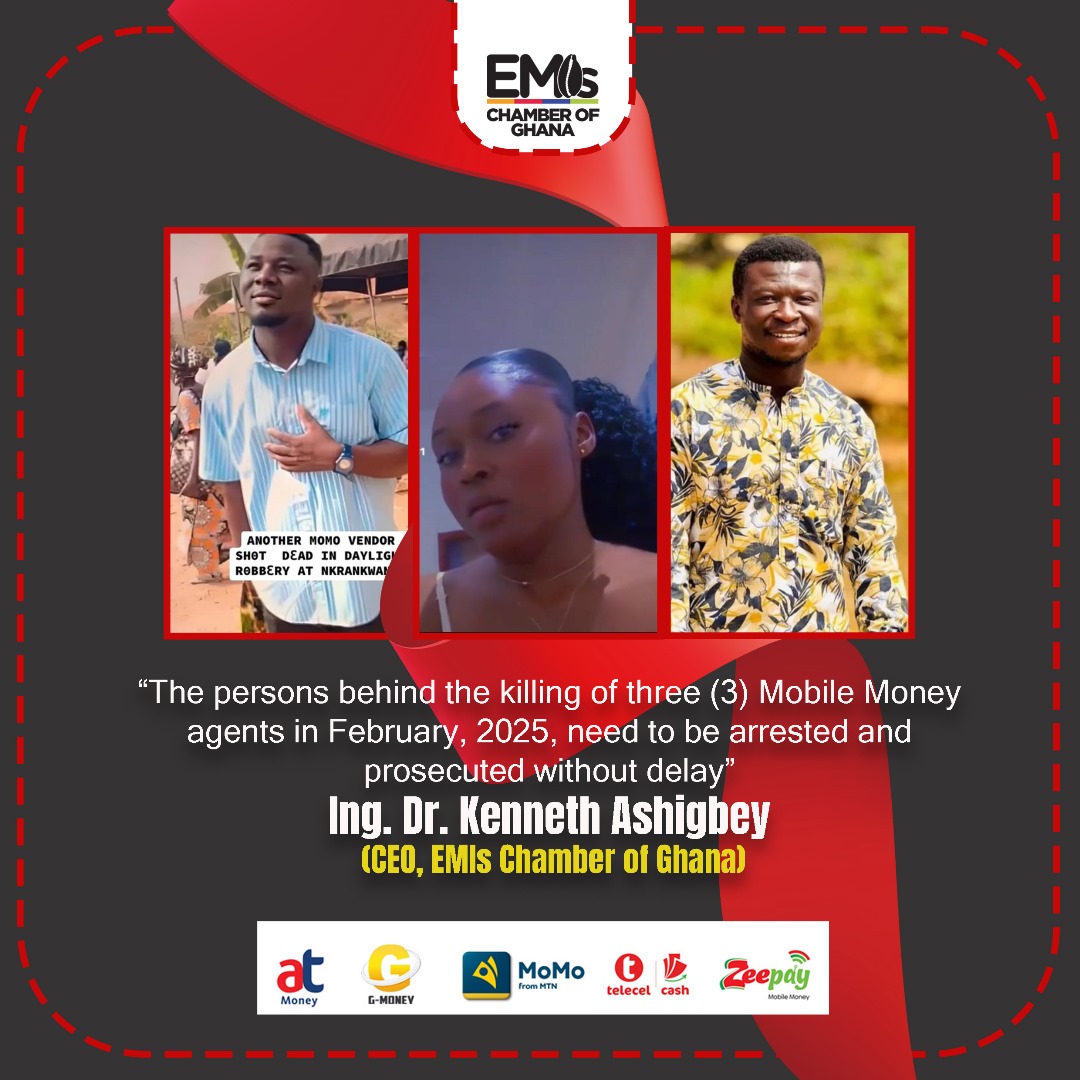

He also expressed concern over the recent violence and insecurity mobile money Agents face in their line of work with the increased spate of attacks from armed robbers. Mr. Addo gave the assurance that MobileMoney LTD was taking the matter very seriously and exploring ways of safeguarding the agents. “Beyond providing the insurance cover, we will also continue to work with relevant stakeholders to improve security for mobile money agents and ensure a holistic approach to our intervention”, Mr. Addo concluded.

Explaining the benefits under the insurance cover, the Chief Commercial Officer of MoMo from MTN, Abdul-Razak Ali, reiterated that the insurance comes at no cost to agents and gave the assurance that MobileMoney LTD has paid the premium for all agents.

Chief Executive Officer of aYo Ghana, Francis Gota, underscored the importance of insurance in mitigating risks, and stated that, “life is unpredictable and mobile money agents work long hours, often facing daily risks. This insurance scheme provides financial support in case of unforeseen circumstances, offering peace of mind to agents and their loved ones.”

Echoing this commitment, CEO of Sanlam Allianz Life Insurance Ghana Ltd, Tawiah Ben Ahmed, assured agents of his company’s dedication to honoring valid claims promptly. “As the life insurer in this partnership, we are committed to providing seamless insurance services and ensuring that claims are paid promptly to support our agents when needed.”

MobileMoney LTD remains committed to supporting its over 300,000 mobile money agents nationwide to thrive and operate in a safe environment. The company initiated the Agents Insurance Scheme in 2020.

Source: Business News