The EMIs Chamber of Ghana, the leading advocacy body for digital financial ecosystem, extends its warmest congratulations to Dr. Johnson Asiamah on his nomination as the next Governor of the Bank of Ghana. His extensive experience in monetary policy, financial stability, and economic research makes him well-positioned to steer Ghana’s financial sector towards greater innovation and inclusion.

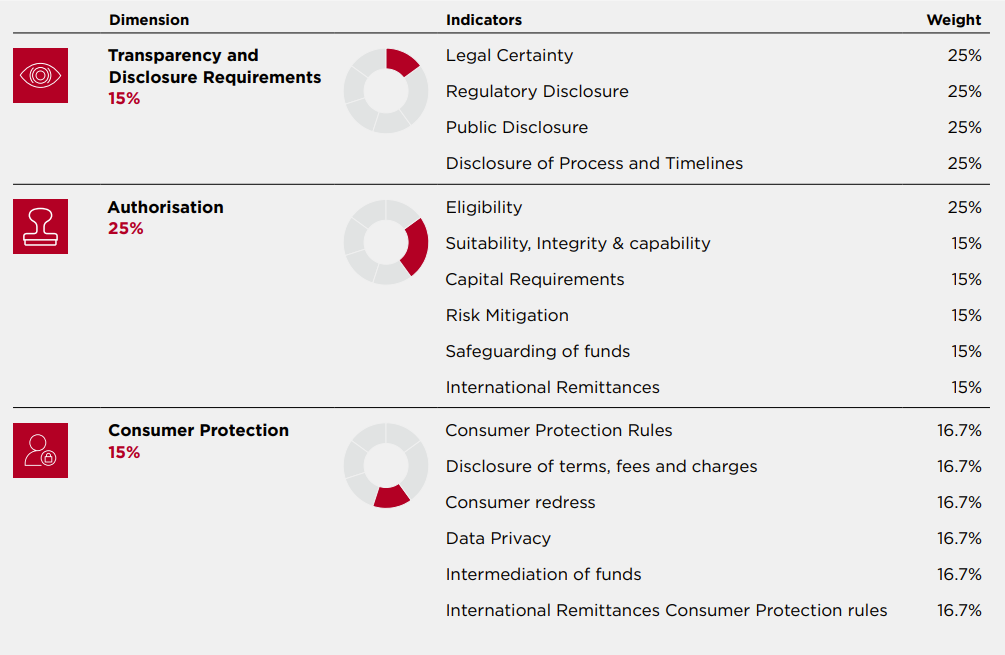

As we look forward to Dr. Asiamah’s tenure, the Chamber remains committed to working closely with the Bank of Ghana to further strengthen Ghana’s digital financial ecosystem, ensuring continued innovation, consumer protection, and financial inclusion for all Ghanaians.

As captured in the release announcing his nomination, Dr. Asiamah’s nomination follows the acceptance of a formal request by the current Governor, Dr. Ernest Addison, to proceed on leave ahead of his retirement on March 31, 2025.

With over 23 years of experience at the Bank of Ghana, Dr. Asiamah brings a wealth of expertise in monetary policy, financial stability regulation, and economic research. He previously served as Second Deputy Governor of the Bank of Ghana from 2016 to 2017 and holds a PhD in Economics from the University of Southampton, UK.

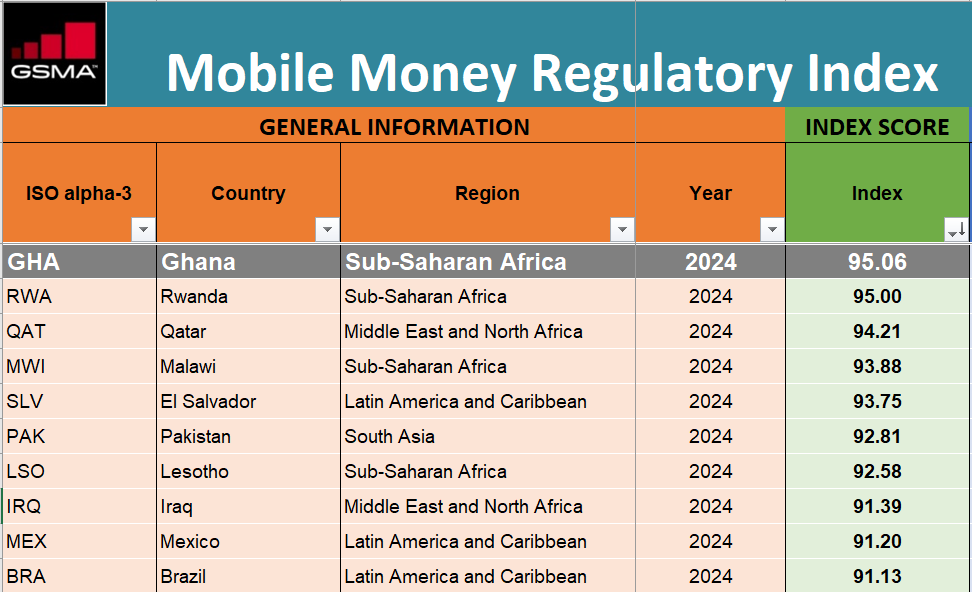

We also take this opportunity to commend Dr. Ernest Addison, the outgoing Governor, for his invaluable contributions to the country’s digital financial ecosystem. Under his leadership, the Bank of Ghana championed progressive regulatory frameworks that have significantly advanced financial inclusion and the growth of electronic money institutions.

Congratulations once again to Dr. Johnson Asiamah, and best wishes to Dr. Ernest Addison on his next chapter.

Full release below: