As telecommunications operators continue to manage an expanding array of threats, here’s the EY analysis of the 10 biggest risks they face in 2025.

In brief

- Trust and talent issues lead the sector risk landscape, as security threats escalate with responsible AI and digital skills also in focus.

- Ineffective technology transformation and value chain disruption are new entries, reflecting changing internal and external pressures.

- As we enter 2025, telcos must take a holistic, ecosystem-wide view of risks — and zero in on the role of people and tech in their transformation efforts.

The global telecoms industry’s comparatively strong share price performance in the past year suggests it has weathered recent challenges, such as the cost-of-living crisis, relatively well. However, the industry faces significant existing and emerging threats — and every telco needs to recognize and address these.

As in previous years, telcos’ risks can be broadly categorized into four types: compliance, operational, strategic and financial. But much has changed within this overarching framework over the past 12 months. For example, the industry’s risk profile has shifted toward the need to transform and drive greater internal efficiency and agility through actions focused both on the workforce and technology stack. At the same time, security challenges continue to evolve in new directions at pace.

Also on the rise are risks around disruptive competition from outside the sector, including from hyperscalers, along with looming threats on the horizon impacting the industry’s value chains. And while artificial intelligence (AI) presents clear opportunities for telcos, it also raises a number of threats that have knock-on effects on several of the specific risks in the top 10.

Risk 1: Underestimating changing imperatives in privacy, security and trust

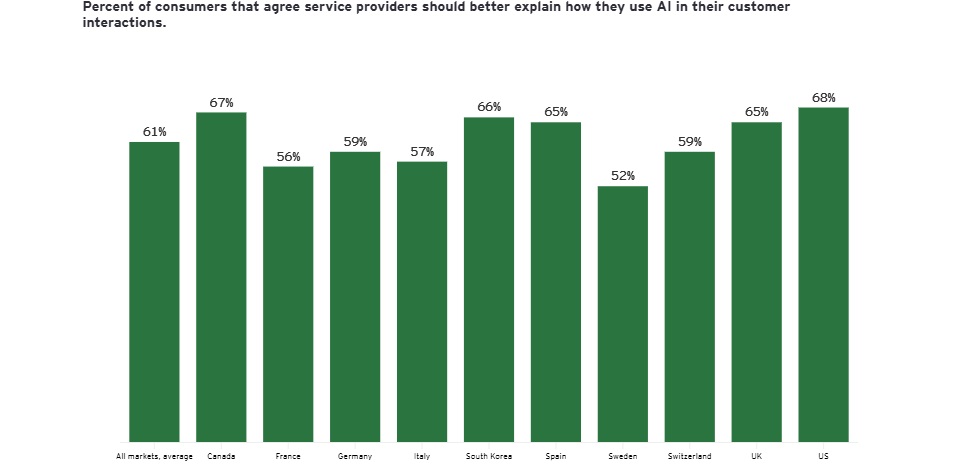

Generative AI (GenAI) is already having a positive impact among connectivity providers, notably in customer support functions. However, EY research finds that two-thirds of customers want better explanations about how AI is being used, while four in 10 employees (via ey.com US) are not confident that they know how to use AI responsibly. Added to this, security threats are evolving at pace: AI is making cyberattacks smarter while 57% of telcos are concerned about security attacks impacting physical assets at a time when sabotage affecting subsea internet cables is on the rise. Looking ahead, telcos’ trust credentials are under unprecedented pressure.

(Source: EY Decoding the Digital Home, October 2024)

Risk 2: Inadequate talent and skills and culture management

The EY 2024 Telco of Tomorrow found that senior industry executives’ people priorities are headed by talent, skills and culture. And when asked to rank the inhibitors of transformation in their organizations, they put poor internal collaboration and missing skills second and third respectively, behind lack of budget. The sector’s relatively high degree of remote working — as highlighted by the EY Work Reimagined Survey — poses particular challenges to collaboration and upskilling. Meanwhile, 85% of telco employees believe HR functions will require major or moderate change over the next five years, underlining the transformation that is required to support better talent management.

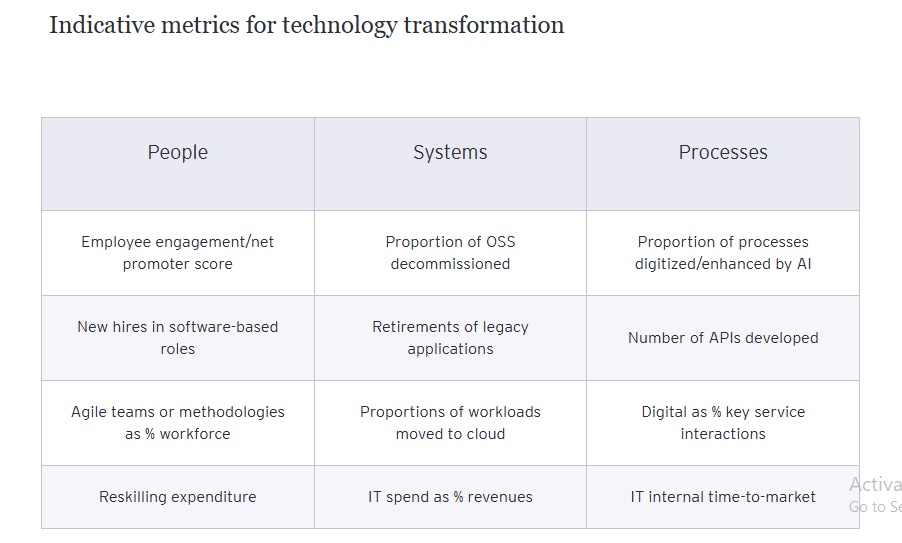

Risk 3: Ineffective transformation through new technologies

A range of emerging technologies will propel transformation of telcos in the future: The EY Telco of Tomorrow research shows that process automation and software-based networks are currently seen as the most important, but that AI is expected to dominate in years to come. Here there are strategic choices to make, from use case prioritization through to the selection of open source of proprietary large language models. Crucially, telcos also face important decisions on what performance measures to use. While confidence in AI’s transformative potential is high, the right KPIs will be vital in assessing the progress of transformation programs.

Risk 4: Poor management of the sustainability agenda

Effective reporting of sustainability progress is essential for telcos. Yet according to the 2024 EY Climate Action Disclosure Barometer, the quality of climate disclosures by telcos and tech companies stands at just 55%, well below the 94% rating for disclosure coverage. And while climate change is likely to be a material risk for many companies in the sector, only 36% reference climate-related matters in their financial statements, typically via qualitative rather than quantitative references. Equally worrying, just 51% of telecoms and technology companies currently disclose their plans for transitioning to renewable energy sources.

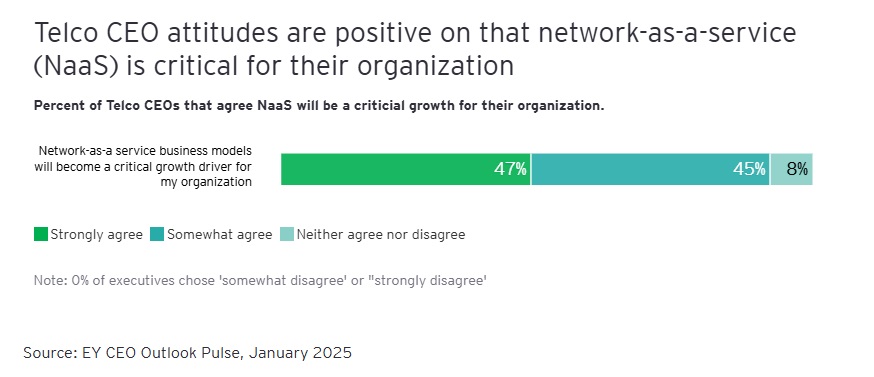

Risk 5: Inability to take advantage of new business models

Telcos are under pressure to seek new routes to revenue growth, given that recent subscription price hikes may not be sustainable. Emerging network-as-a-service business models are in focus, with 92% of telco CEOs viewing them as a critical growth driver in the future, while many operators are doubling down on network application programming interfaces – a market predicted to reach US$6.7b by 2028.1 However, realizing these ambitions will be made harder by telcos’ heavy reliance on intermediaries. Similarly, their ability to increase revenues from B2B customers may be hampered by factors like “co-opetition” and service delivery challenges.

Risk 6: Inadequate network reliability and resilience

Despite ongoing infrastructure upgrades, EY research shows that more than one in four households often suffer from unreliable fixed broadband connectivity, with no improvement year-on-year. Mobile data reliability is in decline, both in perceived reliability and tested throughput levels, while more sophisticated 5G standalone (SA) networks offering better performance levels have been slow to materialize. Against this challenging backdrop, AI presents both opportunities and risks around network quality — helping operators manage their networks better, but also potentially squeezing capacity by increasing uplink traffic.

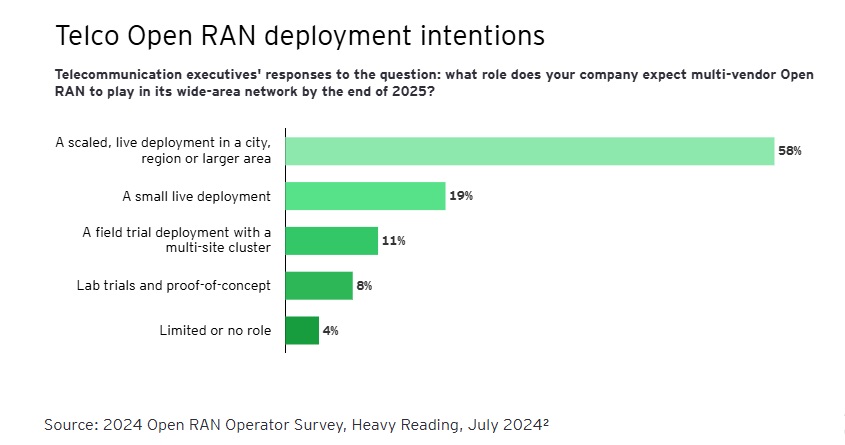

Risk 7: Ineffective engagement with external ecosystems

Changing supplier ecosystems offer telcos new routes to growth and efficiency. The shift to open radio access networks (Open RAN) promises several positive impacts for operators, ranging from a greater choice of vendors to improved network capabilities. However, only 17% of telcos cite Open RAN as a critical element of their network strategy, with many first-phase deployments still relying on a single vendor. Partner ecosystems also require focus: the EY Reimagining Industry Futures Survey 2024 (pdf) finds that enterprise customers prefer service providers that provide capabilities through partners. Robust ecosystem relationships will be mission-critical for telcos going forward.

Risk 8: Failure to mitigate value chain disruption

Telcos are expecting their competitive landscape to broaden and evolve over the coming years, signalling new challenges. While they currently regard other telcos and mobile virtual network operators (MVNOs) as being among their top three competitive threats, they expect hyperscale cloud providers to dominate the competitive landscape in five years’ time, with satellite companies also posing a growing challenge. As telcos face these shifting pressures, they’re lagging behind others in the ecosystem on R&D spending, potentially limiting their long-term ability to innovate. Industry research shows telcos spend only 1% of their revenue on R&D — well behind network equipment providers at 17%.3.

Risk 9: Inability to adapt to the changing regulatory and policy landscape

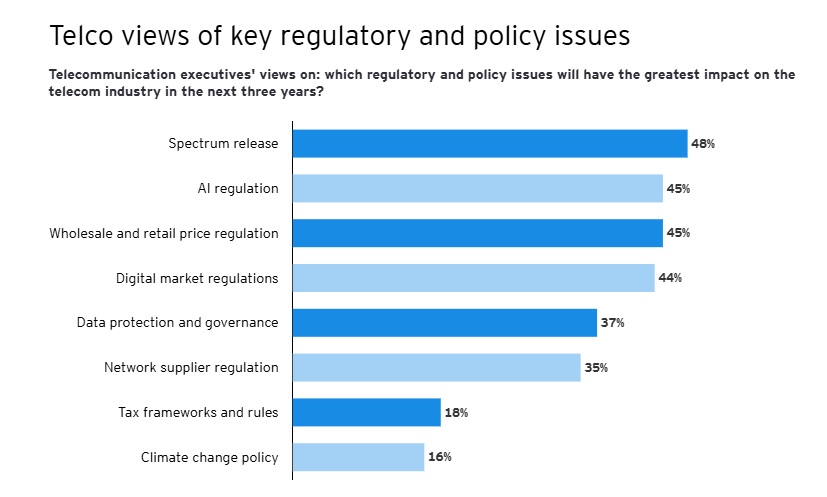

The EY Telco of Tomorrow Survey finds that industry leaders expect to face a widening range of regulatory and policy issues, with a growing impact from emerging domains like AI regulation and digital markets. Further challenges include network supplier regulation, which is both in flux and inconsistent between countries. Alongside new areas of regulation, established regulatory domains are evolving in new ways. Spectrum sharing rules are being proposed and updated in various countries while regulations on pricing are expanding in scope, driven by consumer protection policies, with pricing controls even featuring as part of merger remedies.

Risk 10: Inadequate operating models to maximize value creation

Asset-light strategies are continuing to gain ground, with operators in multiple regions carving out or spinning off tower, fiber and data center assets. EY research finds that 72% of telco CEOs believe that carve-outs and divestitures will increase in their region in the coming 12 months. Further out, 44% of telco leaders believe the industry will split into retail-focused “servcos” and wholesale-oriented “netcos” within the next five years. While asset-light M&A brings financial benefits, opportunities to reconfigure operating models are being overlooked: most executives believe that they should have done more with the remaining business during divestment than simply eliminate costs.

Actions for telecommunications operators to manage risk mitigation

We believe three overarching actions can help operators mitigate the risks we’ve highlighted.

- Identify emerging threats affecting the ecosystem

As connectivity assumes an increasingly central role in digitization, telcos need to identify risks that are emerging outside their organization — whether in supply chains, the competitive landscape, or the policy and regulatory space. Identifying such risks requires ongoing proactive monitoring of the external environment. This is particularly true of the cybersecurity and policy areas, which are both evolving at pace. - Focus on the impacts of people and technology transformation

Telcos’ transformation horizons are adapting to new possibilities unlocked by frontier technologies, adoption of which is also being accelerated by rising stakeholder demands for efficiency and sustainability. But alongside the need for new tech, the requirement for re-skilling and fresh talent has never been higher. All of this means the transition to new technologies should be accompanied by a clear organizational purpose, robust risk protection and effective governance to maintain business resilience as transformation programs progress. - Ensure end-to-end risk management: Telcos’ risk management approach should be holistic and programmatic, with a clear process for identifying, evaluating and managing risks across the organization. This involves executive risk owners working with cross-functional teams to track risks and assess their impacts, accompanied by regular reviews of risk containment plans and controls effectiveness. Above all, it’s vital to embed a risk culture throughout the business — one that can adapt and respond to changes in risks as they emerge and evolve.

Summary

As telecoms operators embark on 2025, they’re confronted by a risk universe that blends internal threats centered on the imperative for operational and workforce transformation, with external threats springing from shifts in the competitive, technology and regulatory landscapes. The keys to successful risk mitigation in such an environment? A forward-looking risk perspective that considers threats across the enterprise and its entire ecosystem — supported by a risk-oriented culture that enables rapid and effective responses.

Source: Cedric Foray & Adrian Baschnonga (EY Global)