Writer: TechAfrica News Editor- Akim Benamara

5G is being positioned as the future of connectivity —powering everything from AI-driven industries to smart agriculture and autonomous systems. It’s fast, efficient, and capable of transforming economies. In Sub-Saharan Africa, 5G’s contribution to the economy is projected to reach $10 billion by 2030 (GSMA), accounting for 6% of the overall economic impact of mobile. By the end of 2023, global 5G connections had surpassed 1.5 billion, making it the fastest-growing mobile technology in history.

But while the rest of the world surges ahead with 5G, Sub-Saharan Africa still faces a different reality—one where 3G remains the primary network for millions of people, and 4G adoption is progressing at a considerably steady pace, and some are even still using 2G. As of 2023, only about 31% of mobile connections in Sub-Saharan Africa were on 4G and 1.2% on 5G (though expected to increase to 50% and 17% respectively by 2030). This seemingly slow transition isn’t just about infrastructure; high device costs, affordability barriers, and uneven network coverage mean that for many, even 4G remains out of reach.

So, how do we talk about 5G’s potential when millions of Africans are still unconnected?

The reality is, we can’t just skip steps. A rapid push for 5G won’t automatically bridge the digital divide—in fact, it could make it worse. If millions remain stuck on 2G and 3G while 5G networks expand in isolated pockets, we risk widening the connectivity gap rather than closing it. Before we embrace the promise of 5G, we need to ensure that existing technology—particularly 4G—is maximized to bring as many people online as possible.

In this #TechTalkThursday, we’ll explore why striking a balance is crucial, advancing 5G while ensuring that 4G reaches its full potential in Africa.

The Current Landscape: Where Africa Stands Today

While much of the world has moved on to 4G and 5G, Sub-Saharan Africa remains a 3G-dominated region. According to GSMA, a staggering 60% of online users in Sub-Saharan Africa still rely on 3G technology, which is slower, less energy-efficient, and limits access to digital services like mobile banking, e-learning, and telemedicine. Although 4G adoption is on the rise, it is not happening fast enough to drive the kind of digital transformation needed to close the connectivity gap.

The growth of 4G across the continent has been constrained by two major obstacles: affordability and coverage. Even as mobile operators expand their 4G networks, many Africans cannot afford 4G-enabled devices, which remain out of reach for lower-income households. Additionally, rural areas are still underserved, with large parts of the population lacking access to reliable 4G networks. Yet, despite these challenges, 4G is expected to become the dominant mobile technology in Africa by the end of the decade. The shift is happening, but not fast enough to bridge the digital divide before 5G begins to take center stage.

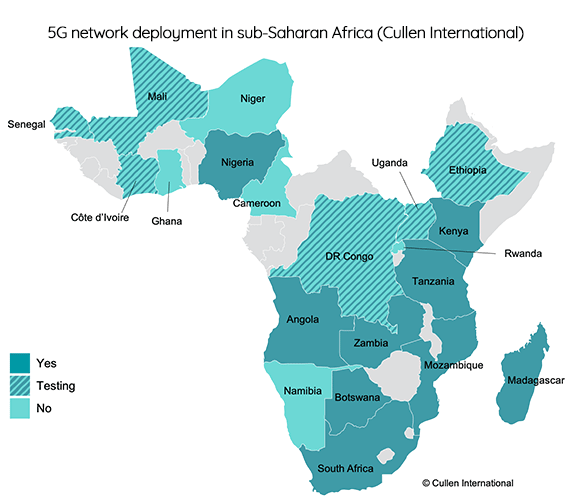

On the other hand, the promise of 5G is beginning to take shape in Africa, but it remains a story of limited deployment rather than widespread adoption. South Africa, Nigeria, and Kenya are expected to account for more than half of all 5G connections in Africa by 2030, according to GSMA. However, across much of the region, 5G remains in the trial and early rollout phase, with infrastructure, device affordability, and demand still posing major obstacles. For many telecom operators, the focus is still on expanding 4G coverage before making large-scale investments in 5G.

This makes sense: while 5G is the future, most Africans are still making the transition from 3G to 4G, not from 4G to 5G.

Why 5G Might Not Be the “Immediate” Answer

While 5G undoubtedly has its advantages, it might not necessarily be the immediate answer to Africa’s digital divide. The infrastructure demands alone pose a significant challenge—5G requires dense fiber networks, extensive tower upgrades, and higher energy consumption, all of which come at a steep cost.

As Angela Wamola, Head of Sub-Saharan Africa says in an interview with TechAfrica News, “Investment is still needed at the 4G level to support the consumer, but even greater investment is required for the future, focusing on 5G and beyond.”

Device affordability is another major barrier to its adoption. The median income in many African countries makes 5G-capable smartphones an unaffordable luxury for the average consumer. Even as prices gradually decline, the reality is that millions still struggle to afford even entry-level 4G devices, keeping next-generation connectivity out of reach for the majority.

For telecom operators, prioritizing 5G in regions where even 4G coverage remains patchy is neither financially nor logistically viable.

Sitho Mdlalose, CEO of Vodacom South Africa, tells TechAfrica News,

“I think the main challenges to rolling out 5G will continue to be the core challenges we face on our network. The cost of rolling out the network is substantial. Vodacom has pledged another 60 billion Rand over the next five years, committing about 10 billion Rand a year to the network, as we have done for the past five years. This investment is crucial, but much of what we have is imported, and the exchange rate plays a significant role in that”

– Sitho Mdalose, CEO, Vodacom South Africa

Beyond infrastructure and affordability, the practical use cases for 5G in Africa don’t yet align with the continent’s most pressing connectivity needs. While industries in wealthier nations are exploring 5G-powered smart factories, autonomous vehicles, and AR/VR applications, Africa’s digital priorities remain far more fundamental—mobile banking, e-learning, e-health, and small business digitization. Pushing 5G in markets where basic internet access is still a privilege risks creating a two-tier digital economy, where wealthier urban centers race ahead while rural and underserved communities remain stuck on outdated networks.

The real danger isn’t just slow 5G adoption but it’s rushing into 5G while millions remain disconnected or struggling on 3G. If digital transformation is truly about inclusion, then the smarter path is clear: maximize the potential of 4G first, then build towards 5G when the ecosystem is ready. Bridging the gap isn’t just about technology—it’s about ensuring that no one is left behind in the digital economy.

The Smart Approach: Advancing 5G While Strengthening 4G

Africa’s digital transformation doesn’t need to be an either-or-scenario between 4G and 5G, but rather a careful balancing act that ensures progress without leaving vast swaths of the population behind. To achieve meaningful digital inclusion, we must first expand 4G access, lower the barriers to affordability, and introduce 5G rollouts strategically—in high-demand areas while strengthening the foundation elsewhere.

To effectively tackle affordability barriers, a more coordinated approach is required, with local manufacturing playing a key role. By producing affordable smartphones within the continent, the cost of imports could be significantly reduced, passing those savings directly to consumers. Additionally, programs like Kenya’s Safaricom “LipaLater” financing plan, which allows consumers to pay for devices in instalments, can make 4G smartphones more accessible to low-income users.

“The affordability of devices is crucial, and at Vodacom, we’ve explored several solutions to address this, including our ‘easy to own’ innovation, which allows consumers to pay daily installments for a smartphone, starting at as little as 8.50 Rand per day. As you pay, it provides both data and the ability to use and unlock the smartphone.”

– Sitho Mdlalose, CEO of Vodacom South Africa

This approach should be complemented by government and operator subsidies to ensure broader affordability. Moreover, taxes on devices should be reassessed to reduce the financial burden on consumers, and the high cost of data must also be addressed to make mobile internet more affordable for all.

“If we can solve the challenge around the affordability of 4G devices, we can leapfrog even those customers still on 2G—representing the 44% who have never accessed mobile broadband—straight into 4G. This would allow them to benefit from the infrastructure that’s already developed, helping to close the gap across Sub-Saharan Africa, where there is still a long road ahead in terms of digital access.”

– Angela Wamola, Head of Sub-Saharan Africa, GSMA

But device affordability is only part of the equation. 4G infrastructure expansion is crucial for ensuring that no one is left out of the digital revolution. Many rural areas remain disconnected, not because people lack the desire to connect, but because deploying infrastructure in remote locations is cost prohibitive. Governments, alongside telecom providers, must direct more Universal Service Fund (USF) resources toward these areas, encouraging network expansion where it matters most. Universal Service Funds (USFs) in this case have largely underperformed in many African countries, with substantial portions of allocated resources remaining unspent or misdirected, hindering efforts to expand connectivity in underserved and rural areas where it is needed most.

“Insights from the GSMA report on Universal Service Funds in Africa indicate that the funds are underperforming and have become ineffective tools to close the coverage gap, signaling the need for reforms”

– Caroline Mbugua, HSC, Senior Director, Public Policy and Communications, Sub-Saharan Africa, GSMA

There is also the opportunity to repurpose existing 3G spectrum for 4G use, maximizing network efficiency and expanding coverage without requiring entirely new infrastructure. By sharing towers and collaborating with local entities, telecom companies can lower deployment costs, allowing them to focus on connecting more people, not just urban elites.

Maximizing the potential of 4G is not just about providing faster speeds; it’s about unlocking new economic and social opportunities. In agriculture, farmers can access real-time market prices and weather information via mobile phones, helping them make better decisions. In healthcare, telemedicine can bring urban specialists to rural clinics, providing much-needed expertise where it’s most needed. Education, too, stands to benefit, with digital literacy programs and e-learning platforms helping to bridge the gap for students who would otherwise be left behind. Strengthening 4G connectivity now will set the stage for future growth, ensuring that when 5G does arrive, it doesn’t just cater to a privileged few but builds on a connected base that can fully take advantage of the next wave of digital transformation.

The approach to 5G must be deliberate, not rushed. Instead of a blanket rollout, targeted deployments in specific areas—such as industrial hubs, ports, or tech campuses—where 5G can drive the most immediate impact should be prioritized. For example, in South Africa, the mining sector has already started testing 5G to enable smart mining solutions and increase safety through real-time data monitoring.

For Africa to truly benefit from the promise of 5G, the path must be inclusive and pragmatic, focused on first ensuring every African is connected to the technologies they need to improve their lives.