Ghana has emerged as the number one African country with fully interoperable multiple instant payment systems. This was revealed in the 2024 West Africa Banking Industry Customer Experience Survey report from KPMG.

Highlights from the State of Inclusive Instant Payment Systems in Africa Report 2024 revealed that Africa boasts 28 IPS across 20 countries, with only seven countries operating multiple IPS. According to the report the country stood out amongst the 7 leaders outperforming regional peers such as Morocco, South Africa, Egypt, Nigeria, Kenya, and Tanzania, thereby setting a new standard for the continent.

“Ghana’s leadership in this space is evident, being the only African country with fully interoperable multiple instant payment systems” the report stated.

Ghana’s two primary IPS, the Ghana Interbank Payment and Settlement Systems (GhIPSS) Instant Pay (GIP) and Mobile Money Interoperability (MMI), have been interacting flawlessly over the years, winning over admirers from across the world and customers locally.

Instant Payment Transactions See Significant Growth

The impact of instant payment systems in Ghana has been noteworthy. Here are some highlights from October 2024:

– GIP transactions surged by 174% in value and 32% in volume compared to the same period in 2023.

– Mobile money transactions dominated, reaching GHS 2.36 trillion, marking a 55% year-on-year growth.

– The number of mobile money transactions increased by 20% to 6.6 billion.

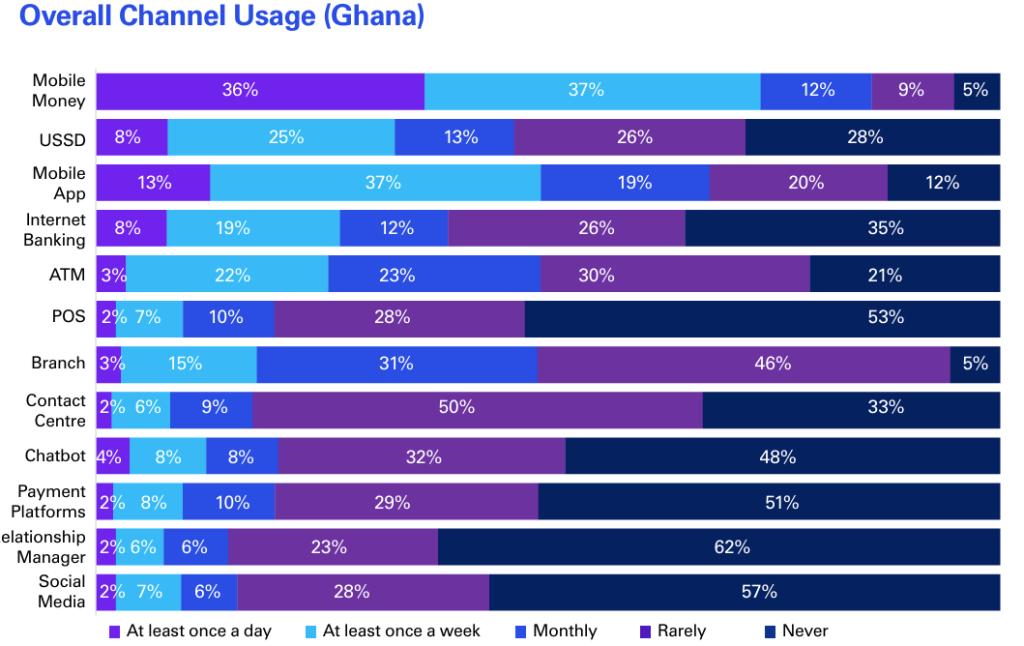

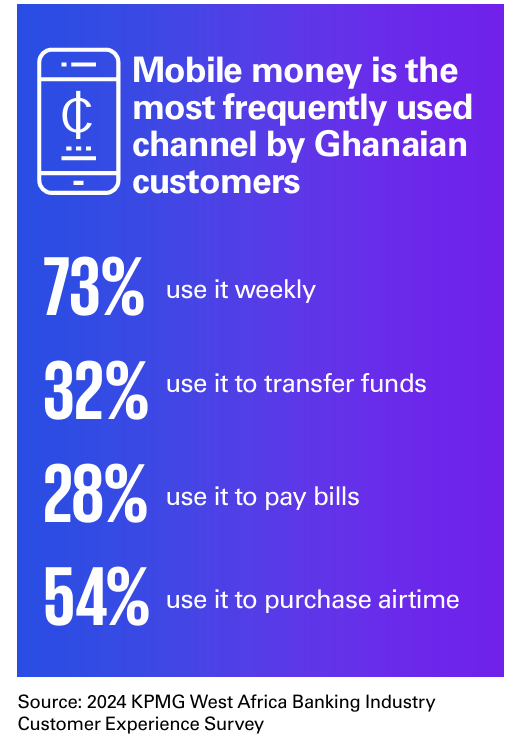

The report’s findings underscore the importance of interoperability between systems, with 73% of retail customers indicating they use mobile money weekly. The ease of transferring money between accounts and mobile wallets also remains a top priority for customers.

While Ghana excels in instant payment systems, the report also highlights areas for improvement, including concerns over service reliability, cybersecurity, and the need for innovative features in mobile apps and internet banking.

As Ghana continues to lead the way in instant payment systems, the country is poised to drive financial inclusion, convenience, and economic growth, setting a benchmark for other African countries to follow.