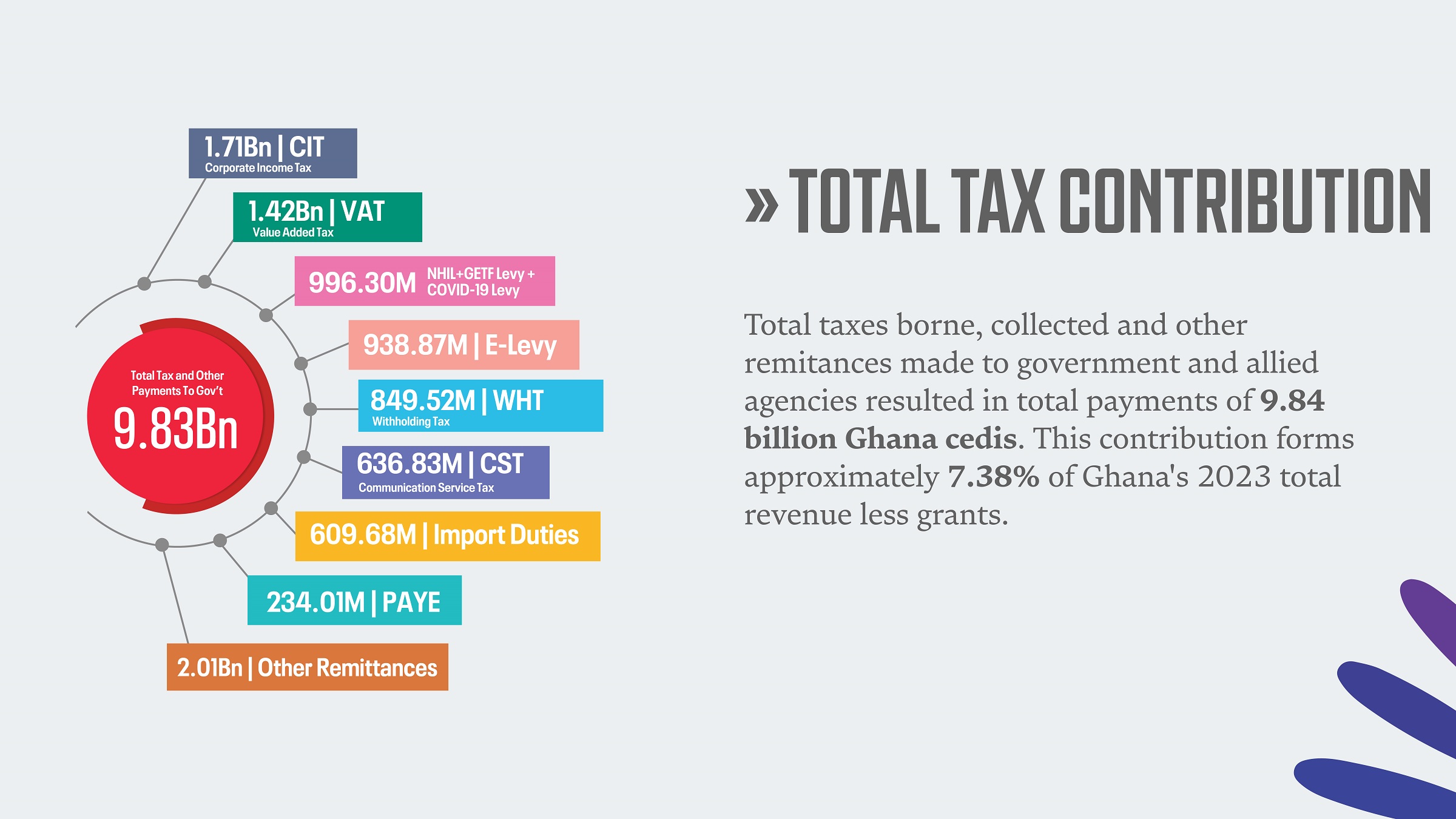

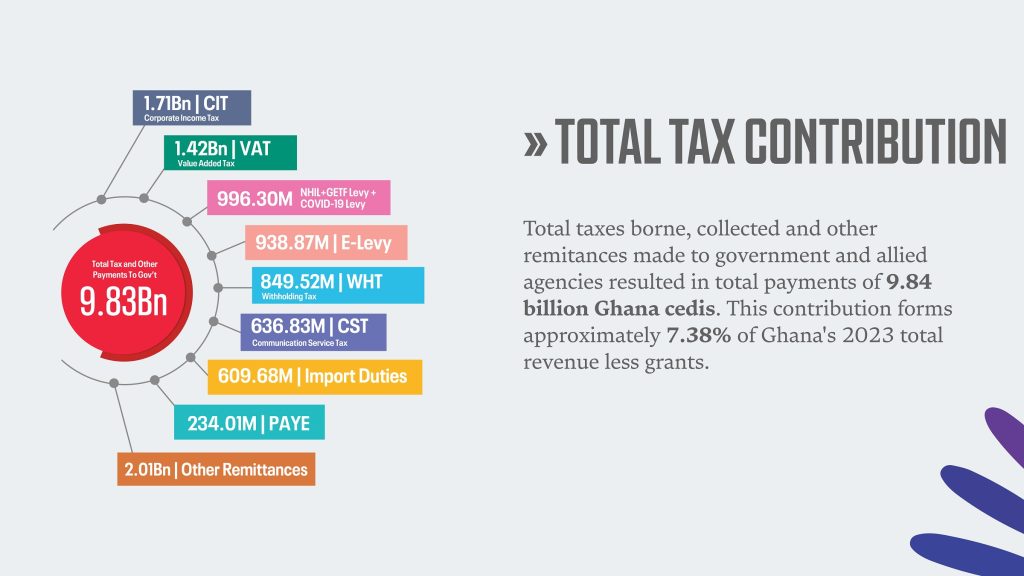

The total contribution of the telecommunications industry by way of taxes, fees, levies, and other payments to government in 2023, has risen by more than 30%. The industry’s overall taxes and other payments to the government in 2023 rose to GHS 9.84 billion, up from GHS 7.32 billion in 2022.

This was made known by the Chief Executive Officer of the Ghana Chamber of Telecommunications (GCT) and the EMIs Chamber of Ghana, Ing. Dr. Kenneth Ashigbey during the launch of the 2023 Mobile Industry Transparency Initiative Report in Accra. The event was well attended by representatives of members of both Chambers, members of the media, and external validators including Mr. William Demitia, a law lecturer at the University of Ghana and Mr. Gordon Dardey, Partner at KPMG.

The annual report, based on data from members of the Ghana Chamber of Telecommunications including AT, MTN, Vodafone, ATC, Helios, Comsys, CSquared, Ericsson, and Huawei, and members of the EMIs Chamber of Ghana including AT Money, G-Money, Mobile Money Limited, Telecel Cash and Zeepay, aims to illustrate the industry’s societal and economic contributions to the country’s development.

During his presentation, Dr. Ing. Kenneth Ashigbey, revealed that the industry’s tax contribution and other payments span various categories, including Corporate Income Tax (CIT), Value Added Tax (VAT), Communication Service Tax (CST), Import Duties and the E-levy, among others. The CIT alone contributed GHS 1.71 billion, while VAT and CST amounted to GHS 1.42 billion and GHS 636.83 million respectively. Additionally, import duties and other remittances formed a substantial part of the total tax payments.

This extensive contribution according to Dr. Ashigbey underscores the industry’s commitment to Ghana’s economic progress. Beyond taxes, the telecom sector is pivotal in driving socio-economic development. With approximately 35 million mobile connections in Ghana, mobile penetration boosts jobs, productivity, and financial inclusion. Mobile money, for instance, has made financial services accessible to the unbanked, particularly benefitting micro, small, and medium-sized enterprises (MSMEs).

The report also highlighted the industry’s contributions to employment, with over 5,800 direct and indirect jobs (not counting the jobs created for mobile money agents and others). The industry also demonstrated a strong commitment to corporate social responsibility, investing millions into social initiatives across the country.

These contributions showcase the ongoing efforts of the telecom industry to align with government revenue goals, support national development, and bridge the digital divide in Ghana.

Methodology

The study employed the Total Contribution methodology, encompassing both tax and non-tax contributions made by GCT members as well as members of the EMIs Chamber to government.

Tax contribution breakdown

Corporate Income Tax (CIT) jumps from GHS 1.35 bn to 1.71bn

The breakdown of tax contributions included Corporate Income Tax (CIT), increased from million to GHS 1.35 billion in 2022 to GHS 1.71 billion, accounting for a significant rise of approximately 26.62%

VAT grows from GHS 930 m to GHS 1.42 bn

Value Added Tax (VAT) surged from GHS 930 million to GHS 1.42 billion, marking it as the second most significant tax category for the industry after Corporate Income Tax (CIT). The report shared by the Chamber demonstrated a notable increase of 52.04 % in VAT in 2023.

Withholding Tax jump to GHS 849.5 bn in 2023

Withholding Tax (WHT) continued to grow in 2023 like it did in 2022. WHT rose from GHS 699.25 million in 2022 to approximately GHS 849.52 in 2023, indicating an increase of about 21%. The continued rise can be attributed to escalating business costs and increased spending, impacting the overall industry value chain.

Communications Service Tax (CST)

Proceeds from the Communications Service Tax (CST) rose by 25% in 2023, from a figure of GHS 509.46 million in 2022 to GHS 636.83 million in 2023. This industry specific tax continues to put a damper on the potential volume growth and affects the affordability of data and voice for the Ghanaian subscriber. We would continue to propose that the rate of CST should be reduced in the near term or scrapped entirely.

GHS 2.01bn in other remittances

The report further highlighted that; other remittances collectively contributed GHS 2.01 billion in 2023. Other Remittances jumped because of surcharge on international inbound call termination (SIIT). Though in USD terms the amount it increased by just 1%, in cedi terms it increased significantly by more.

Import Duties rise from GHS 330.9 m in 2022 to GHS 609.7 in 2023

Import duty collections in 2023 stood at GHS 609.68 million. This rise can be attributed to among other things the significant depreciation of the Ghana Cedi against its major trading partners in 2023. As highlighted in the previous edition of this report, there’s a pressing need to focus efforts on developing and implementing local solutions that alleviate pressure on the local currency. Additionally, we propose that government considers waiving some import duties and taxes on some critical telecommunications equipment that are very important for the country’s development. This should also include components for the provision of solar energy other than the panels that are currently exempt.

Pay as You Earn

The report’s analysis revealed a significant growth in the Pay as You Earn (PAYE) tax line, inching up from GHS 167.2 million in 2022 to GHS 234.01 million in 2023 marking a 39.95% increase. This demonstrates not only the growth in payments made to our direct employees but also the numbers employed within an environment where unemployment is a critical national challenge. This is one of the reasons why the government should consider easing the fiscal burden on the industry to enable it further expand its employment capacity.

E-Levy increases by 93.8%

Electronic Transfer Levy (E-Levy) collected in 2023 stood at GHS 938.87 million, a rise of about 94% from the GHS 484.5% paid by the industry in 2022. The reduction in the E-Levy rate has resulted in some recovery in the volumes and values. But there is the need for further revision in this policy to align it to government’s digital by default strategy.

An Industry Poised for Growth with Tax Reforms

Beyond the numbers highlighted above, the telecom industry has positioned itself as the horse pulling the economic cart up the hill, making invaluable contributions to the digital transformation and connectivity needs of Ghana.

As a driver of economic progress, the telecom industry holds the potential to bring more people into the formal economy, particularly in the informal sector, which is traditionally outside the tax net. Through innovations in mobile money, data services, and digital platforms, telecom companies can facilitate the tracking of transactions and financial flows within the informal sector, creating an opportunity for the government to expand its tax base. By working closely with the telecom industry, the government can develop policies and systems that encourage the registration and taxation of informal businesses, thereby boosting national revenue. This partnership can create a win-win situation, where the informal sector benefits from access to digital financial tools and the government increases its revenue from a broader tax base.

Additionally, the government can play its part in supporting the telecom industry by reconsidering the current taxes (especially industry specific ones) and rates. A more extensive tax base with fair rates could ultimately foster a more sustainable and inclusive economy, as businesses of all sizes would feel more inclined to operate within the formal economy, knowing that their contributions are fairly assessed.

In summary, the telecom industry’s growth is not just about revenue; it is about creating a more inclusive, connected, and robust economy. By enabling greater formalization within the informal sector and fostering digital access, the industry empowers individuals and businesses to participate more actively in the economy. With the government’s support in refining tax policies to encourage compliance and reduce the burden on citizens, Ghana can leverage this synergy to accelerate growth and drive sustainable development across the nation.

Note: All 2022 figures have been revised to reflect the final confirmed figures from members of the Ghana Chamber of Telecommunications and the EMIs Chamber of Ghana.

Source: Chamber News Desk