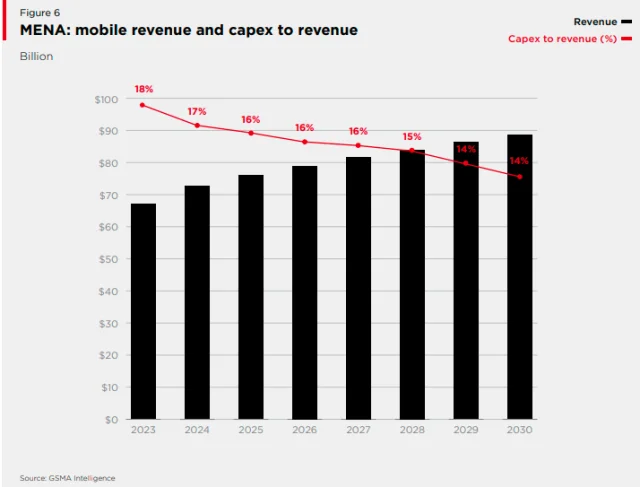

Investment by telecom operators in the Middle East and North Africa will reach $97 billion during 2023-2030. Mobile operators will generate revenue of $88 billion in 2030 as compared with $66 billion in 2023.

Build on the GCC region’s leading position in 5G adoption by enhancing coverage and quality. Kuwait, UAE, Qatar, and Saudi Arabia have advanced 5G networks supported by strong policy frameworks and consumer readiness.

Extend 5G commercial services to less-covered regions like North Africa and the Levant, leveraging lessons from GCC markets.

Deploy 5G Standalone (SA) Architecture to enable capabilities like network slicing, allowing operators to tailor connectivity for specific industries and service-level agreements.

Utilize SA networks to support enterprise solutions, including smart factories, smart grids, and IoT applications.

Accelerate adoption of 5G-Advanced Technologies to enhance mobility, reliability, and efficiency for applications such as extended reality (XR), AI-driven designs, and low-latency services.

Focus on new capabilities like uplink enhancements and multicast technologies to deliver innovative enterprise and consumer solutions.

Promote Fixed Wireless Access (FWA) as a use case for 5G, particularly in markets with underdeveloped fixed broadband infrastructure.

Launch specialized FWA offerings, such as gaming-specific packages, to meet diverse customer needs and increase market share, as seen with Du in the UAE and STC in Saudi Arabia.

Grow cellular IoT connections, which are expected to reach 80 million in MENA by 2030, focusing on markets like Türkiye and Iran.

Use 5G RedCap for mid-tier IoT applications like smart metering and industrial automation, balancing cost and performance.

Partner with public cloud providers (e.g., e& and Microsoft) to integrate cloud and edge computing into 5G networks, driving new enterprise solutions and revenue streams.

Offer edge computing services to industries requiring low-latency solutions, such as manufacturing, logistics, and gaming.

Focus on industries with high 5G adoption potential, such as manufacturing, public administration, and finance, which are projected to account for significant portions of 5G’s $50 billion economic impact in MENA by 2030.

Develop applications and services that utilize 5G’s high-speed, low-latency capabilities, such as AR/VR gaming, immersive media, and enhanced mobile broadband (eMBB).

Improve customer satisfaction by addressing specific needs, as demonstrated by the success of FWA in replacing traditional broadband in Saudi Arabia and the UAE.

Utilize network slicing to create tailored offerings for industries like healthcare, education, and logistics.

Offer APIs for fraud prevention, security, and quality enhancements, as part of initiatives like the GSMA Open Gateway.

Continue infrastructure investments to enhance network reliability and scalability while adopting green technologies to improve energy efficiency and meet sustainability goals.

Leverage government support in GCC markets for deploying advanced network solutions and sustainable technologies.

These strategies position telecom operators in the Middle East to capitalize on the transformative potential of 5G, driving economic growth, enhancing customer experiences, and unlocking new revenue opportunities.

Recent 5G Activities

Du and Huawei implemented an indoor 5G-Advanced network in the UAE to enhance connectivity in shopping malls, hotels, airports, and residential spaces.

STC and Ericsson deployed automated radio resource partitioning on its 5G standalone (SA) network, preparing for a high-performance, programmable 5G-Advanced network.

e& verified Ericsson’s RedCap software solution on its 5G SA network, aiming to scale RedCap implementation across the UAE.

Vodafone Qatar achieved speeds exceeding 10 Gbps using 6 GHz spectrum in a phase-two trial showcasing the capabilities of 5G-Advanced technologies.

Zain Saudi Arabia invested $425 million to expand its 5G network and digital services ecosystem, with 45 percent of the investment allocated to 5G-Advanced technologies.

STC Kuwait and Huawei launched RedCap Fixed Wireless Access (FWA) commercially, leveraging advanced 5G capabilities.

Du and Nokia conducted a RedCap trial over Du’s commercial network, demonstrating new possibilities for 5G evolution.

MENA in numbers

Mobile subscribers in MENA are projected to grow from 517 million in 2023 to 574 million by 2030, representing a penetration rate increase from 64 percent to 71 percent.

The number of mobile internet users is expected to rise significantly, driven by expanded 4G and 5G coverage.

The mobile ecosystem accounted for $20 billion in GDP in 2023, with operator revenues reaching $66 billion. By 2030, total revenues are forecast to hit $88 billion.

The sector supports 500,000 direct jobs and an additional 700,000 indirectly.

By 2030, 5G is projected to account for 35 percent of mobile connections, showcasing rapid technological adoption.

Licensed cellular IoT connections will experience a compound annual growth rate (CAGR) of 2.4 percent between 2023 and 2030.

Source : Baburajan Kizhakedath(telecomlead)