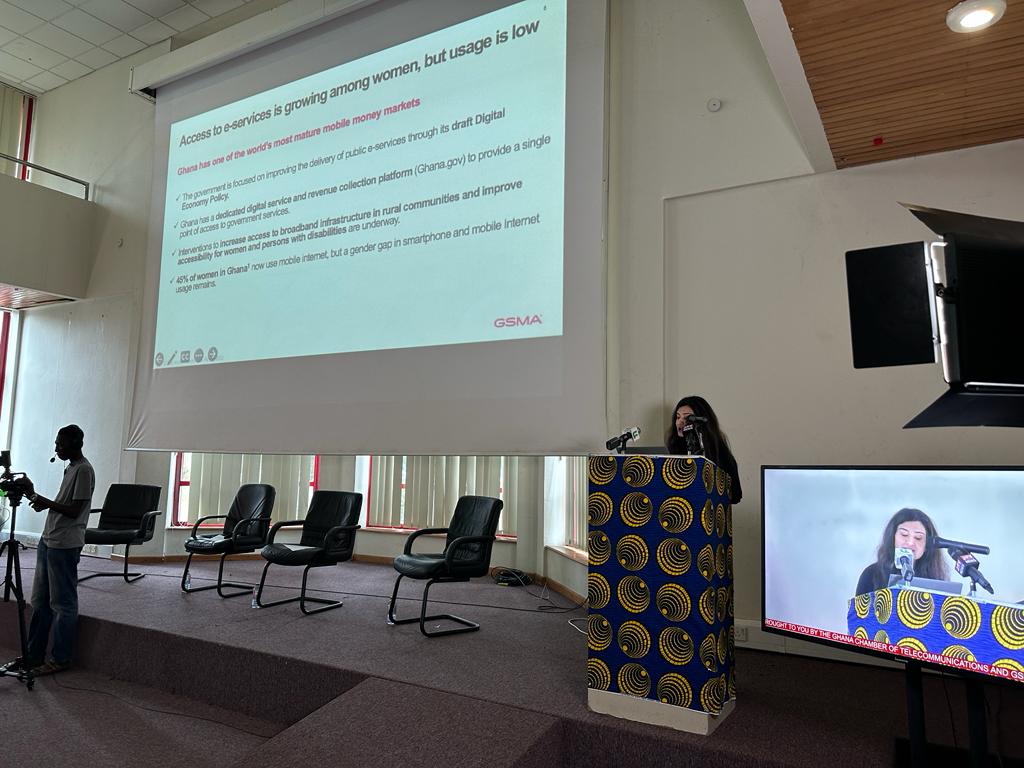

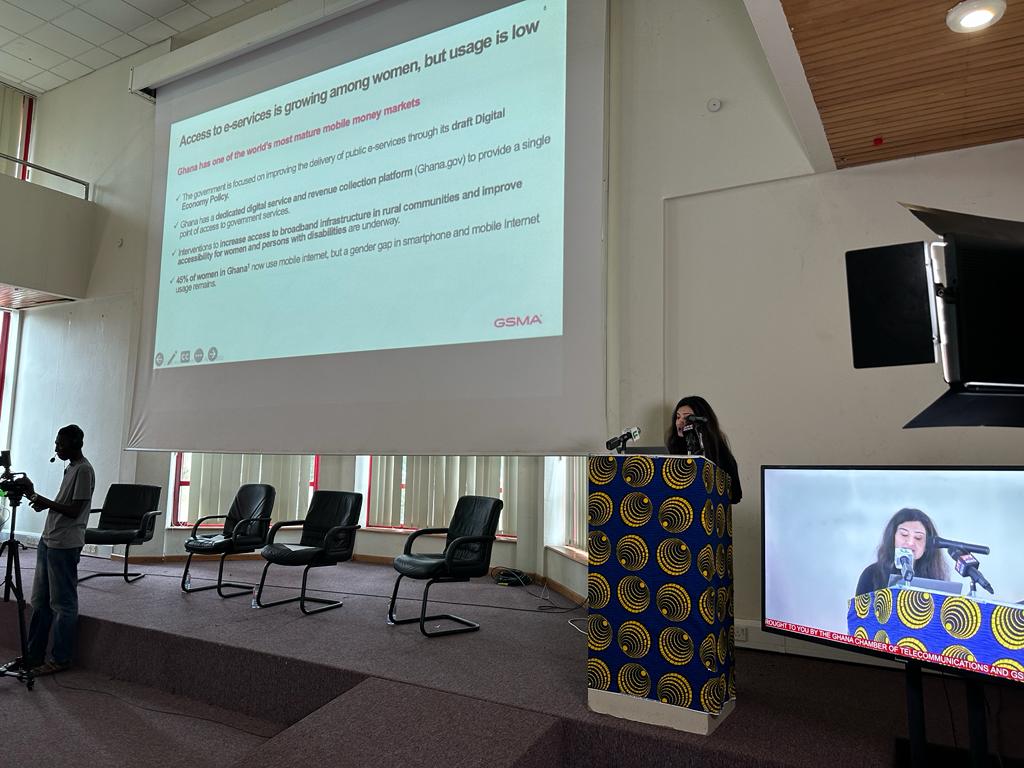

The remarks were made at the 22nd Knowledge Forum organized by the Ghana Chamber of Telecommunications in partnership with the GSMA. The theme for the event held in Accra on August 8, 2023 at the Kofi Annan ICT Centre of Excellence was Digital Public Services for All: Understanding Ghana’s Opportunity to Leverage Mobile Money for Inclusive Service Delivery.

Data from the presentation delivered by GSMA’s Nigham Shahid at the event revealed several obstacles to the adoption of government e-services: One key challenge is affordability, affected by smartphone expenses, internet charges, and mobile service taxes, all of which discourage women from engaging in mobile transactions. Another issue is the insufficient availability of up skilling initiatives tailored for women. Women, especially, express greater worries about their safety, security, and the risk of falling victim to scams, compared to men. Additionally, the absence of services offered in local languages and the limited acceptance of formal banking services also contribute to the constrained utilization of electronic government services.

Subsequently, around 40% of women were not utilizing e-government services due to insufficient awareness and understanding of these services. About 11% mentioned they had no requirement for such services, another 11% cited the absence of a smartphone, and a similar percentage pointed to limited literacy as a factor. Additionally, 10% expressed a lack of confidence, while the remaining portion highlighted inadequate funds for data as a key reason for the limited adoption of e-government services.

Speaking about the relevance of the event in an interview with the Chamber News Desk, Nigham Shahid highlighted the benefits of enhancing the inclusion of women in the digital ecosystem.

Meanwhile, the Chief Executive Officer of the Ghana Chamber of Telecommunications, Ing. Dr. Kenneth Ashigbey underscored the need for government to look into removing taxes on smart phones. He stated thus “The government should look into removing taxes on smart phones to make them more accessible to our own citizens. By eliminating taxes on smartphones, the government can effectively reduce the financial burden on individuals and families, especially those with lower incomes. This would not only make smartphones more affordable for a wider range of people, but it would also promote digital inclusion and ensure that everyone has equal access to the opportunities and benefits that come with owning a smartphone.”

Additionally, he remarked that, “removing taxes on smartphones would stimulate the economy by encouraging more people to purchase these devices, leading to increased adoption of digital literacy skills”.

During the panel discussion, experts addressed the challenges inhibiting women’s engagement with e-government services in Ghana. They noted that Ghana’s government has been actively pursuing digital initiatives to foster inclusivity, yet women’s utilization of e-services remains limited. Factors like affordability, literacy, security concerns, and access to relevant services continue to hinder progress.

Consequently, the gender gap in mobile internet use, smartphone ownership, and digital literacy were identified as key contributors. To bridge the divide, the panel emphasized strategies such as subsidizing device costs, creating tailored digital literacy programs for women, and enhancing financial inclusion through mobile money services. They proposed embedding e-government modules in digital literacy training, offering real-time support for users, and designing user-friendly platforms.

The panel also underscored the importance of collaborations between financial entities, technology firms, and regulators to amplify accessibility and utilization. As Ghana strives for digital equality, these insights shed light on pathways for progress.

Source: Chamber News Desk